Page 1

LILAC Document Help

Creditor Posting

This document may be used as a means of data entry, typically purchasing of an overhead or indirect expense item, usually upon receipt of such a creditor invoice, which typically may not relate to inventory. For example, rent, rates, phone, electricity.

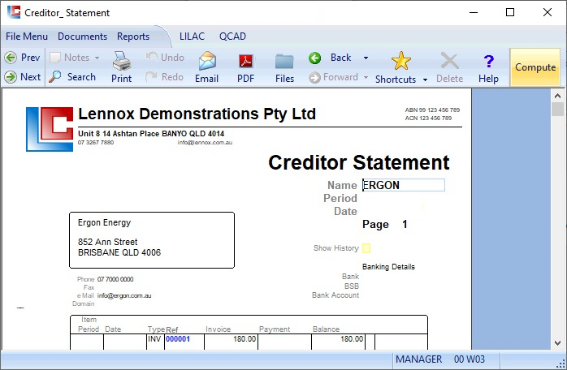

Posting a credit to a LILAC creditor account will result in funds owed to a creditor. Review at: Reports > Creditors > Aged Trial Balance.

Applied entries in the Creditor Posting document are presented in the Creditor Payment document, ready for payment.

Posting a credit to a LILAC creditor account will result in funds owed to a creditor. Review at: Reports > Creditors > Aged Trial Balance.

Applied entries in the Creditor Posting document are presented in the Creditor Payment document, ready for payment.

Creditor Posting

Most purchasing of goods and services relating to inventory may be processed via the LILAC Purchase Order document, which generates inventory, creditor, and GST entries automatically. This means the Creditor Posting document may see infrequent use, usually being reserved for non inventory postings.

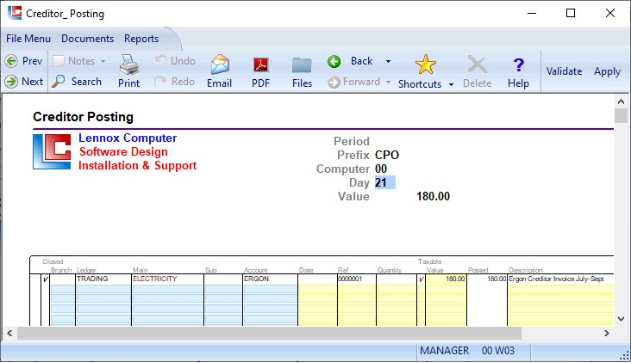

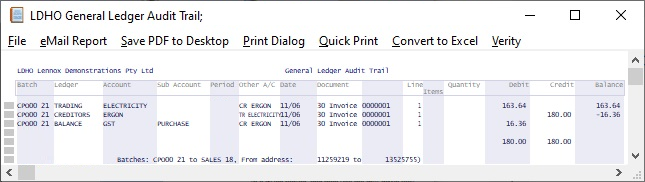

Each line of entry in the body of the Creditor Posting document will generate a "double-entry", a debit and a credit.

The Creditor Posting document allows a debit accounting entry to be posted to an account within the LILAC integrated ledger system. This debit account is identified by the first four pale blue columns, Branch, Ledger, Main (Account), Sub. For example, in the case of a creditor invoice received from, an electricity supplier, the account to be debited (from the Chart of Accounts) may typically be TRADING > ELECTRICITY (which may be categorised as an Indirect > Expense > GST inclusive).

The fifth column in the body of the Creditor Posting document, Account, is the Creditor Account, where a simultaneous offsetting credit is posted. In this example ERGON is used, the electricity supplier and the source of the creditor invoice.

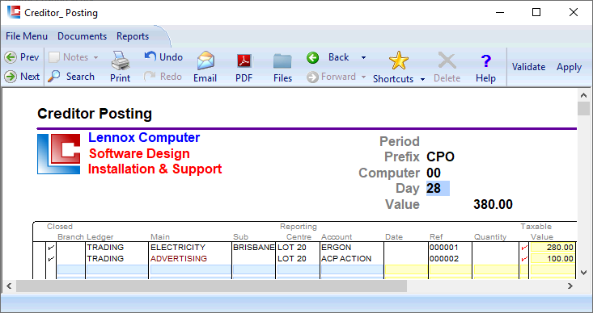

Multiple postings can be made in one batch (CPO0021), by using the lines and pages provided in this document.

Each line of entry in the body of the Creditor Posting document will generate a "double-entry", a debit and a credit.

The Creditor Posting document allows a debit accounting entry to be posted to an account within the LILAC integrated ledger system. This debit account is identified by the first four pale blue columns, Branch, Ledger, Main (Account), Sub. For example, in the case of a creditor invoice received from, an electricity supplier, the account to be debited (from the Chart of Accounts) may typically be TRADING > ELECTRICITY (which may be categorised as an Indirect > Expense > GST inclusive).

The fifth column in the body of the Creditor Posting document, Account, is the Creditor Account, where a simultaneous offsetting credit is posted. In this example ERGON is used, the electricity supplier and the source of the creditor invoice.

Multiple postings can be made in one batch (CPO0021), by using the lines and pages provided in this document.

Debit posting.

Creditor Account to be creditied.

The yellow columns are intended to describe the accounting source document, typically the invoice from a supplier/creditor.

Date: Use the date from source document.

Ref: You may use the invoice number from the source document.

Quantity: Typically leave blank if appropriate.

Taxable: Includes GST. A tick in the Taxable column implies that 1/11th of the Value column is to be posted as GST to the BALANCE/GST/PURCHASE account and 10/11ths posted to the debit account.

Value: Value, dollar amount.

Posted: 'Apply' from the ribbon will generate accounting entries, posting the value, placing a tick in the closed column. The applied line(s) will become uneditable, except for the value field to allow for correction.

Description: Provide a description as necessary.

*Branch: Permits the costing to be directed to a subsidiary in a group of companies. Leave this field blank if the cost is to be directed to the current entity.

*Sub: A chart of Sub Accounts may be used which are subordinate to the main account names. Leave blank if not necessary.

Date: Use the date from source document.

Ref: You may use the invoice number from the source document.

Quantity: Typically leave blank if appropriate.

Taxable: Includes GST. A tick in the Taxable column implies that 1/11th of the Value column is to be posted as GST to the BALANCE/GST/PURCHASE account and 10/11ths posted to the debit account.

Value: Value, dollar amount.

Posted: 'Apply' from the ribbon will generate accounting entries, posting the value, placing a tick in the closed column. The applied line(s) will become uneditable, except for the value field to allow for correction.

Description: Provide a description as necessary.

*Branch: Permits the costing to be directed to a subsidiary in a group of companies. Leave this field blank if the cost is to be directed to the current entity.

*Sub: A chart of Sub Accounts may be used which are subordinate to the main account names. Leave blank if not necessary.

The Day field forms part of the Key for this document in this period. It must be filled in to provide a (Batch) reference. Enter the day of the month, e.g. 21. Or, the users initials, e.g. AB. It must be two characters in length. Previous entries in the Day field within this Period are retrievable with right mouse click or F12.

For example the Key for this example is:

CPO00 21

CPO: Prefix (Creditor Posting)

Computer: 00 (Computer 00)

Day: 21 (21st day of the month)

For example the Key for this example is:

CPO00 21

CPO: Prefix (Creditor Posting)

Computer: 00 (Computer 00)

Day: 21 (21st day of the month)